Day trading is a popular method of making money in the stock market. Essentially, it involves buying and selling securities within a single trading day, with the goal of making a profit based on short-term price fluctuations. Day trading can be done with a variety of securities, including stocks, options, and futures contracts.

What is Proprietary Day Trading?

Proprietary trading is a term used to describe when a firm or company trades with its own money rather than on behalf of clients. In other words, the firm uses its own capital to make trades and profit from them. Proprietary trading can be done with a variety of securities, including stocks, options, and futures contracts.

How Does Proprietary Day Trading Work?

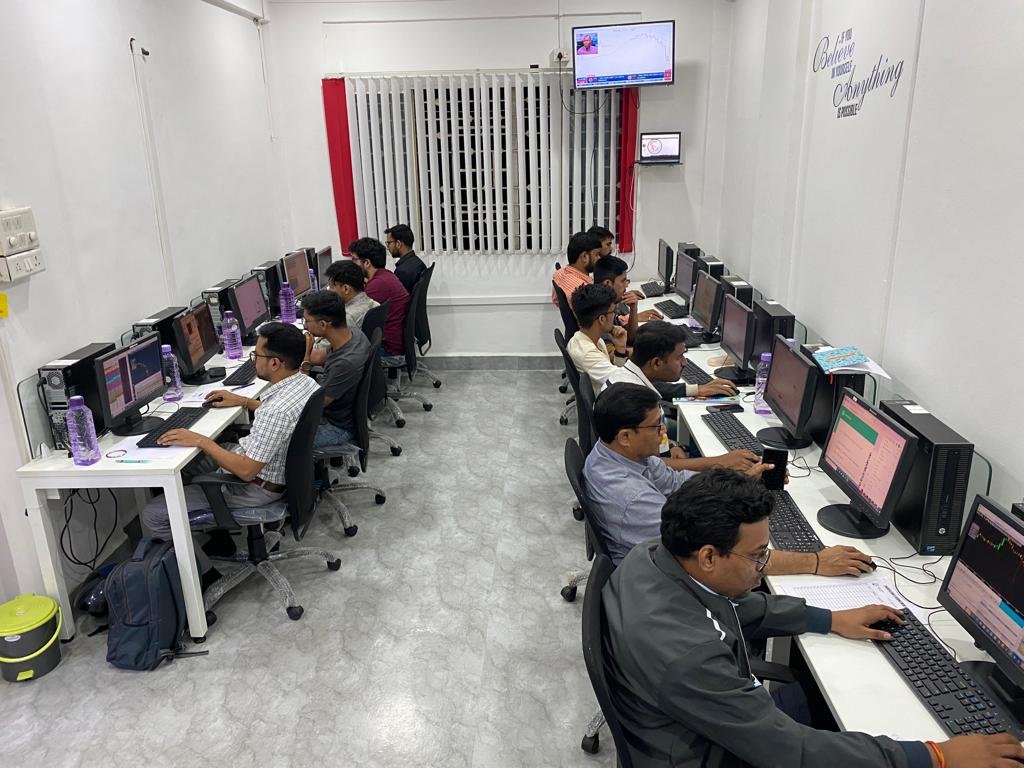

Proprietary day trading can be done by individuals, but it is more commonly done by firms or companies. These firms employ professional traders who use the firm’s capital to make trades and generate profits.

Why is Proprietary Day Trading Popular for Businesses?

Proprietary day trading is a popular strategy for businesses for several reasons. First, it can be highly profitable when done correctly. Day traders can make significant profits in a single trading day, which can be a boon to a firm’s bottom line.

How to Apply for a Proprietary Trading?

Build your trading skills: World Trades Academy typically look for candidates with strong quantitative and analytical skills, as well as experience trading in the financial markets. Consider taking courses, attending workshops, or practicing with a virtual trading simulator to improve your skills.

Prepare your resume: Highlight your trading experience and any relevant certifications or degrees.

Apply online: World Trades Academy proprietary trading firms have online application processes. Follow the instructions carefully and if the candidate is really passionate for success as a day trader then they can try with World Trades Academy but first they will have to submit the Check Eligibility Form Form.

Prepare for interviews: If you’re selected for an interview, be prepared to discuss your trading strategies and experiences and understand market trends and risks. Practice answering common interview questions and be ready to provide specific examples of your trading success.